ASSET MANAGEMENT PARTNERS

Portfolio Value and Performance Maximisation

With strategic advisory, professional services & innovative systems

Table of Contents

01

What We Do

Our valuation, asset, and portfolio management solution

02

Is This Right For You?

What our Asset Management Partnership (AMP) package includes

03

Review & Assess

In relation to your portfolio ask the following questions

04

The Benefits

A highly professional personalised partnership service allowing the investor to make fully supported decisions

05

Appointment

Once appointed what we do

06

Who We Are

Our philosophy, memberships, associations, regulations and philosophy

WHAT WE DO...

We provide a fully accessible and transparent valuation, asset, and portfolio management solution.

valuation assessment & management

We centralize all your data into one place and enable improved, informed decision making, reduced risk and maximization of returns and performance.

We facilitate Real time asset and portfolio valuations, performance, and analysis with the ability to present lease by lease cash flow valuations, discounted cash flows and traditional RICS red book valuations.

scenarios/risk analysis

We introduce and monitor integrated budgeting and forecasting at the asset level, scenarios/risk analysis at the asset and portfolio level.

We manage Asset cash flow at asset level incorporating lease and tenant details, market leasing assumptions, detailed indexation and comprehensive expense and recovery modelling.

Budget/forecasting provide the ability to link the valuation and investment forecasts of assets, groups of assets and portfolios to the actual spend costs to produce an accurate return assessment.

We believe in gaining our clients trust & exceeding their expectations.

We identify early real time identification of impairing tenancies which then ensures minimal risk in defaulting tenants.

We can then quickly analyse the client’s investments based on ever changing market conditions.

sensitivity analysis

We use Sensitivity Analysis to improve decision making for acquisitions, dispositions and “stress-testing” portfolio performance.

We create multiple scenarios for modelling purposes and then produce scenario comparison reports against base and best/worst case or other scenario for the client for valuation and assessment of new acquisitions.

This may include how economic and market changes will impact the value as well as changes in tenancies due to reviews and expiry’s.

portfolio growth

We also facilitate our asset management clients by informing them of the latest opportunities for investment.

Identifying the best investment opportunities, realising changes in market conditions all of which can be capitalised on.

For potential new acquisitions and additions to the portfolio we advise on the acquisition and implications and effects on the overall portfolio to have an informed understanding of the implications of an acquisition and impact of an acquisition on the portfolio.

tenancy managment

We ensure our private asset management clients are kept informed of the impact of lease expiry’s, surrenders, reviews and renewals.

End of term costs are identified, quantified and reported. Capital costs such as refurbishment at the end of a tenancy cycle are taken into consideration and factored into the asset performance, return and value.

New variants affecting the portfolio can be quickly assessed with scenarios adopted and re-forecasted models applied.

Knowing the value of the portfolio and ongoing performance in real time is imperative for decision making.

IS THIS RIGHT FOR YOU?

"We become your partners, managing operations, mitigating threats and taking advantage of opportunities. We provide high level reporting for accurate valuation assessment and maximisation of portfolio returns"

RONAN ROONEY

MANAGING DIRECTOR

Our Asset Management Partnership package includes

Portfolio Advisory Report and Valuation

-

Overall Portfolio value - Value per property / per floor / per type

-

Analysis of risk and associated costs and effects on value

-

Portfolio management update on active and pending lease reviews and renewals

-

Sensitivity and Risks analysis with specific challenges identified

-

Ensuring minimal risk in defaulting tenants by early default detections

-

Assessment of changing market conditions for portfolio impact

A dedicated back end secure web based platform with all property portfolio details including

-

Actual Leases & Contracts

-

Tenancy details

-

BERs Plans etc

-

Condition and Dilapidation reports

-

Compliance documents

-

Valuations

Ongoing Portfolio management

-

Identifying Voids and Impaired tenancies

-

Rent reviews and lease renewals

-

Lease roll overs and re-gearing

-

End of lease refurbishing costs, cost of new lease, rent free periods and inducements all reflected in the actual value return

-

Active Lease management issuing notices for rent reviews, lease renewals and terminations on time

-

Assessment of potential properties for acquisition

Portfolio Review & Assessment

In relation to your business property(s) or portfolio or existing commercial leases....

ask yourself;

PORTFOLIO REVIEW

01

Do you know the Value of your Investment Portfolio inclusive of all the hidden costs involved with voids, lease renewals and capital costs and refurbishments at end of lease terms?

02

Can you easily identify opportunities and threats across the whole portfolio in advance of them becoming compromised?

03

Are you managing your portfolio from day to day or maximising your portfolio value with strategic asset management?

If the answer to any of these questions is No or Maybe and you are open to allowing us to partner you in your plan, then we may be a fit for you.

Real estate revenue is sourced primarily from tenants. But leasing terms and market conditions can fluctuate over time, affecting your ability to create an accurate cash flow model.

We become your Asset Management Partner (AMP) and build a personalised long term partnership focusing on your unique and specific needs and requirements. We commit to ensure high portfolio performance and full value maximisation.

Our Formula

Corporate Infrastructural

Planning Partners

Business Unit Best Use

Optimisation

A

Successful Scalable Property(s) or Portfolio

operating

Effectively, Efficiently and Economically.

Benefits of our

Asset Management Partnership

WHAT WE PROVIDE IS A HIGHLY PROFESSIONAL PERSONALISED PARTNERSHIP SERVICE.

Clients are provided with a secure personal web interface housing all property or portfolio data, reports and appraisals.

We enable our clients to make robust decisions that best support the portfolio at any time during the life cycle of the properties.

Decisions are supported by market advice, prolific and innovative financial valuation software for profit and loss and balance sheet implications.

We provide honest, impartial and highly professional advice that anticipates potential opportunities, mitigates threats or challenges to optimise the property returns and maximise the overall portfolio value.

OUR ASSET MANAGEMENT PARTNERSHIP AGREEMENT ALLOWS YOU THE INVESTOR TO:

Be provided with an annual portfolio valuation and review

Know the real value of the portfolio or any specific property at any time

Monitor the income forecasted and identify weaknesses or potential impairments

Reflect the hidden costs of voids, end of lease fees, and capital or refurbishment costs

Identify future lease expirations and instigate regears where necessary to extend the terms

Evaluate value and suitability of potential investment properties being considered for acquisition in the context of the overall portfolio

Take advantage of opportunities to acquire the freehold interest.

Once Appointed as Partners

what we do...

1

REVIEW & ADVISE

By reviewing your business plan, strategy, objectives, key metrics, opportunities and threats we will identify any problem points in the business property(s) or portfolio.

We review your properties and leases etc. We carry out a comprehensive financial analysis and run cash flow analysis, forecasting and overall portfolio analysis for reporting.

We prepare and present our Portfolio Advisory Report & Valuation which includes our advice on the current status of the properties/portfolio and forecasting milestones for the next 12 months.

We identify threats and opportunities in the portfolio and build detailed cash flow forecasts and stress test market and leasing assumptions.

Our discounted cash flow analysis report will allow you to easily compare monthly budgets against actuals. This way, you can measure performance, identify variants, run scenario tests and re-forecast your budget.

We present a full commercial property valuation using the discounted cash flow analysis – plus other global methods including with strategic actions proposed for your attention and approval. This is repeated annually and after the first year will include a report with a summary of the year’s highlights and performance.

2

MONITOR & MANAGE

By planning, managing and transacting we ensure a Successful Scalable Business Property(s) or Portfolio that is suitable, sustainable, flexible and adaptable.

-

We build a robust returns model with an array of property facts and market assumptions, running scenarios to determine the best and worst case so you have a holistic view of each deal in advance of the acquisition. Once the decision to acquire is made we then negotiate best terms for the acquisition.

-

We then begin our active Asset Management to improve portfolio performance and ensure full value maximisation.

-

We ensure a minimal risk in defaulting tenants by early default detections and Monitoring changing market conditions allows us to advise on acquisitions and disposals.

-

We manage the existing portfolio tenancies rent reviews, lease renewals, surrenders and instigate regearing where necessary to negotiate extensions to lease terms etc to maximise the investment value.

-

We execute property transactions to dispose of or acquire assets with risks minimised and returns maximised to compliment the overall portfolio.

-

For new lettings we not only negotiate the best terms and covenants but also advise on flexible and advantageous lease covenants to be included and onerous lease covenants to be avoided and excluded in the preparation of commercial leases.

-

For new property acquisitions in your investment acquisition pipeline we run a detailed what-if analysis to understand the true impact of changes for the proposed acquisition.

3

REPORTING REVIEW

We then report annually on the previous year’s performance to ensure the business premises are operating Effectively, Efficiently and Economically as a Successful Scalable Business Property(s) or Portfolio.

We then meet our clients in person to present our updated Portfolio Advisory Report & Valuation to review the years performance and review the overall portfolio plan.

This is crucial to ensure the successful monetisation of the portfolio return for the client.

....AND MEETING

"We meet our clients to present our Asset Management Portfolio Advisory Report & Valuation to review the years performance and review the overall portfolio plan."

Ronan Rooney Managing Director

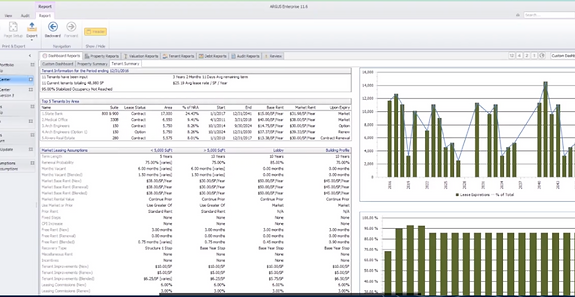

OUR SOFTWARE

Commercial property valuation and cash flow forecasting software

CASH FLOW MODELING FOR ANY ASSET, ANYWHERE

Value and manage the performance of your real estate assets, and use in-depth insights into your real estate portfolio to make smart decisions – quickly and efficiently.

Reporting to suit all investors' needs. So you can mitigate risk and always be one step ahead.

SENSITIVITY ANALYSIS AND SCENARIO TESTING

Property owners operate in an environment that is volatile, complex, and ambiguous. And having live data across multiple spreadsheets is dangerous and inefficient. Especially when you want to report on the health of your properties.

We can run a detailed what-if analysis on an individual property or an entire portfolio. To understand the true impact of changes on your property and portfolio KPIs.

ACQUISITION ANALYSIS

For commercial real estate investors, assessing revenue and capital return is critical to determine if a potential property meets your investment criteria.

We build a robust returns model with an array of property facts and market assumptions. So you have a holistic view of each deal in your investment acquisition pipeline.

Easily import data from the seller, overlay in-house assumptions, and run scenarios to determine the best and worst case.

ASSET BUDGETING AND FORECASTING

Generating and forecasting your asset budgets is often tedious and time-consuming. From collecting data across multiple stakeholders to rounds of reporting and validation, budgeting can land anywhere between six to nine months.

Our software can compare monthly budgets against actuals to measure performance, identify variants, run scenario tests and re-forecast your budget.

Our Web Interface...

A secure personal web interface housing all property or portfolio data, reports and appraisals.

A DEDICATED BACK END SECURE WEB BASED PLATFORM WITH ALL PROPERTY PORTFOLIO DETAILS INCLUDING:

-

Actual Leases & Contracts

-

BERs Plans etc

-

Condition and Dilapidation reports

-

Compliance documents

-

Valuations

All of your business properties details in one secure place with easy private access to personalised interface. This web based platform houses all the details and supporting documents of current past and potential business property(s) in the portfolio including...

TITLE

All title documents for the subject property(s) in the portfolio

CERTIFICATES

Bible of documents, engineer certificates, BER reports, Health & Safety compliance.

LEASES

All commercial lease documents for all retained commercial units including all rent review notices & memorandums.

REPORTS

All report documents including Annual Property Portfolio Reports, risk assessment and sensitivity analysis reports and costs assessment and advisory reports.

CONTRACTS

Asset Management Partnership Agreement, Terms of Engagement, Portfolio suppliers.

WHO WE ARE...

Established in 1968 we are independent and objective property professionals

We focus on our clients portfolio as if it was our own. Our experienced team can facilitate optimal property and portfolio solutions that will maximise the overall value of the portfolio now and into the future.

We partner our portfolio investment clients focusing on optimising the value that each property can bring to the portfolio

We are highly motivated, qualified, experienced and professional but even more we insist on a uniquely personalised service underlined by integrity at all times.

We are members and associates of and regulated by:

The Society Of Chartered Surveyors Ireland (SCSI)

The Royal Institution of Chartered Surveyors (RICS)

The Institute of Professional Auctioneers and Valuers (IPAV)

The European Group of Valuers Association (Tegova)

The Chartered Institute of Arbitrators (CIArb)

And we are RICS Regulated Valuers

Creating relationships is at the core of our services and the value that we add to the portfolio is what determines our client’s success.

We value and enjoy long term relationships with our clients which is a testament to the quality and thoroughness of our work.

We always achieve the best possible outcome with the use of modern techniques and technologies, whilst maintaining our traditional values and integrity.

Rooneys hold a unique combination of local market knowledge, qualifications, experience and entrepreneurial flair to ensure our clients receive an unparalleled service.

We believe in gaining our clients trust & exceeding their expectations.